The oilfield service industry continues to evolve as oil price volatility shows the need for efficiency gains. The recent declines in oil prices have again exacerbated issues in the embattled and fragmented oilfield services space, which has faced declines in revenue and margin deterioration over the last five years. One possible route to financial stability for middle-market oilfield service operators is consolidation, which could improve efficiencies and increase the pricing leverage of the providers that remain.

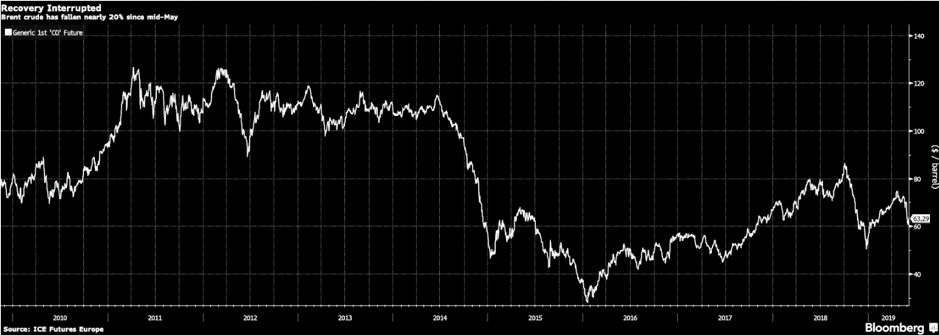

While prices are up from the low levels of early 2016, the oil market has seen brighter days. Recently, and just as oil prices seemed primed for a surge (thanks to oil production cuts by OPEC and decreased investment in new supply), the market saw a hard turn in the opposite direction. With crude trading above $80/barrel in the fourth quarter of 2018 and rising to nearly $75/barrel in late April, the market saw oil prices drop more than 20 percent during the first week of June, falling below $60/barrel. A Bloomberg article attributed the reversal to “rising shale production, a slowing global economy and the prospect of a deepening trade war."

In addition to market-driven distress, the oilfield solutions (OFS) segment has never stood so fragmented, and smaller and medium-sized operators have felt outsized pain due to commodity price volatility. A Deloitte Insights article attempting to decode the oil and gas downturn found that, “OFS has now more than 1,000 listed and private companies worldwide and only six have a market capitalization of more than $10 billion.” Deloitte also noted that the OFS sector has experienced negative net income for four straight years. As margins compress, smaller and middle-market operators face capital constraints as lenders are wary of the risks in the sector. The smaller operators are far from the only businesses experiencing distress: in May, Weatherford, the world’s fourth largest oilfield services company, announced that it would be filing for Chapter 11 bankruptcy to seek protection from its massive debt load of $7.7 billion.

The liquidity crunch is not only being felt from the services side. The Wall Street Journal recently reported that access to capital from banks is limited for shale drillers, as uncertainty in the market affects lender appetite for exposure. Many U.S. fracking companies are now turning to alternative financing methods such as asset sales and drilling partnerships to fulfill their cash needs.

--

The need for consolidation in the industry was reiterated in a recent episode of “The Drilldown”, a podcast featuring energy industry veterans discussing relevant topics.

In a two-part series that premiered in February, “Consolidating the Oilfield” (episodes 102 & 103), the podcast hosts argued that market conditions are ripe for consolidation among oilfield services providers, and such consolidation would lead to regained pricing power and improved overall financial health.

The podcast included a few tangible examples of how inefficiencies in the industry impact profitability. For example – one oilfield services company took on a job at a site that was six hours away from their base. The company also underbid the project – at $1.4 million – when the suggested value of the services was at least $2 million. This example underscored the impact of inefficiencies in the market, which force competitors to bid unnaturally for projects, and realize compressed revenue and margins as a result.

--

In summary - with dynamics like severe fragmentation, volatility in commodity prices and capital constraints, the oilfield services market today seems unsustainable, and change is likely on the horizon. For companies looking to consolidate through acquisition, access to financing can be a hindrance. Given the asset-rich nature of the sector, however, alternative forms of financing – like equipment financing – may provide flexible structures to help capitalize more integrated and efficient new businesses.