Industry Overview for Data Centers

As demand for processing power, storage space and information grows, data hosting is becoming critically more important. Global IP traffic is expected to reach 4.8 zettabytes annually by 2022, compared with 1.5 zettabytes per year in 2017. A zettabyte is a measure of storage capacity, equal to a billion terabytes or a trillion gigabytes – in other words, a ton of data.

As big data usage, storage and privacy/protection increases, the need for data center capacity increases as well, and the market will grow as a result. According to Technavio, global data center market revenue could eclipse $49 billion by 2021, following five years of ~9% annual growth. A data center is a large group of networked computer servers typically used by organizations for the remote storage, processing, or distribution of large amounts of data. Historically, businesses used to own and operate their own data centers, typically operating them on-premise or locally, close to where there was a distributed business campus. However, the number of business data centers is now in decline as on-premise facilities are consolidated into hyper-efficient data centers run by third parties. In addition to storage and data protection, companies are turning to third party data centers for cloud computing capabilities. To meet the escalating demand and increasing complexity, third party data centers are becoming an attractive option. Since data hosting is an energy intensive process, data centers are often located in specific regions with low electricity costs and high storage demands. In particular – northern Virginia, Santa Clara, California, and northern New Jersey are the three largest U.S. data center markets.

Within this geographically-sparse industry, there are two major subsets of hosting services: Colocation and Cloud Hosting. The need for hosting spans industries and geographies – it is critical for healthcare, education, technology development, retail and all businesses managing large data sets and information, but approaches vary and are continually evolving.

-

Colocation provides space, power, cooling, and physical security for the server, storage, and networking equipment of other firms. They can also connect firms to a variety of telecommunications and network service providers while minimizing cost and complexity. Rather than spending money for construction and maintenance of a dedicated data facility, a business can avoid all of those large capital expenditures by colocating in a facility; this way, a business shares the overall infrastructure costs of a data center with other tenants.

-

Another solution is cloud hosting. Cloud providers host on virtual servers, which pull their computing resources from an extensive, underlying network of physical web servers. When compared to colocation and dedicated hosting, cloud hosting is sometimes perceived as more secure, more accessible and more scalable option. This approach is often based on a pay-as-you-go model rather than a fixed subscription model.

Competitive Positioning

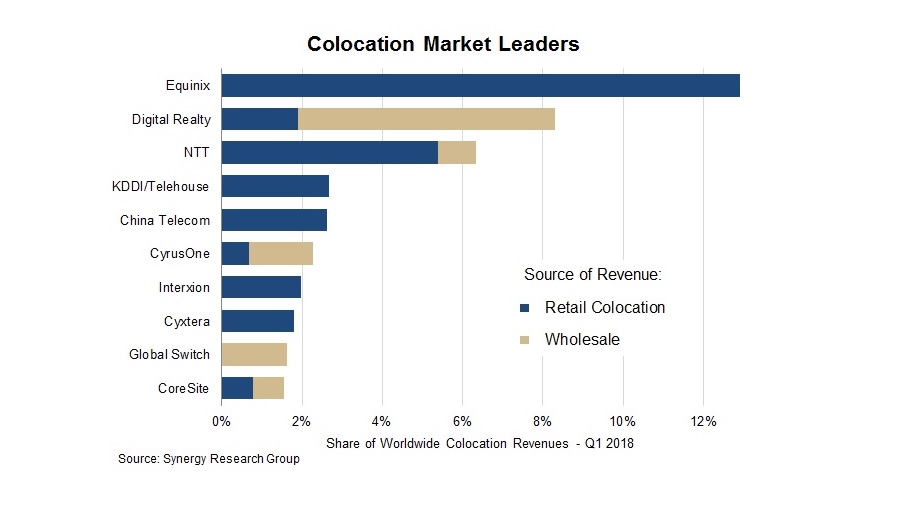

Markets for colocation and hosting are generally segmented based on the lease type and size of the end-user. For example – retail lease providers can offer flexibility and customization as compared to wholesale options, which are generally cheaper but with limited services provided. While large enterprise businesses dominate the market today for colocation / hosting revenue, small and medium enterprises are expected to grow rapidly in the future, driving demand.

Large U.S. data center providers like Equinix and Digital Realty have a commanding share of the colocation market, but numerous smaller competitors exist. Technavio estimates that there are more than 1,500 colocation vendors that operate data centers across the Americas, EMEA, and APAC. A breakdown of market leaders is shown below.

In the cloud computing space, market leadership is held by large technology conglomerates like Google, Microsoft and Amazon Web Services. Other competitors continue to work to offer niche solutions to compete with the larger players and provide more customization and flexibility to their customer base.

Atalaya Leasing Involvement

The data center industry is asset-rich, with continual capex required to meet the needs of growing customer demand. Data centers need meaningful hardware investment in equipment like racks, servers, switches, and network connectivity components. Cloud computing operations are software-intensive and require continual investment in infrastructure as well.

Atalaya is encouraged by positive demand trends in the space and has helped enable several data center businesses to expand capacity through equipment financing arrangements. This experience has allowed us to develop deep in-house expertise on the sector. Because of this expertise, we can underwrite businesses of different sizes, stages of maturity and niches within the industry.