It has been suggested that the construction industry has been slow to embrace the digital age, but several factors—the declining cost of technology, a shortage in skilled labor, and the ever-present desire for safety—have suddenly made construction sites fertile ground for the introduction of robotics. A flurry of new reports predict dramatic, hockey-stick-like increases in the market for construction robotics in the coming years.

The numbers

Starting from a modest $22 million in 2018, market revenue is expected to grow to:

-

$166 million by 2023 according to MarketsandMarkets, and

-

$226 million by 2025 according to Tractica.

The Robotics Industries Association foresees an 8.7% compound annual growth rate over the next four years. The researchers at the International Data Corporation are even more optimistic, predicting a CAGR of 20% in construction robotics.

Perspective

While some heavy equipment has application in both construction and mining, until now the mining industry has been pushing harder toward an autonomous future. It makes sense. Mining operations are more permanent and less populated than construction sites, making them more likely to return tech investments and safer for experimentation. Increasingly, however, the goal of “semi-autonomous operations”—where an operator controls machinery remotely but within sight of it—is coming within reach for the construction industry. For those currently deploying construction robots, common applications include demolition, bricklaying, drilling, rebar tying and assistant robots for lifting loads.

Some details

-

Volvo Construction Equipment just reported a small dip in its third-quarter numbers, but sees a bright spot in its maturing line of autonomous equipment. It has created a separate business unit, Volvo Autonomous Solutions, and just unveiled a pilot program with Harsco to test Volvo’s autonomous, battery-powered hauler beginning in March 2020, at a Harsco site in Sweden.

-

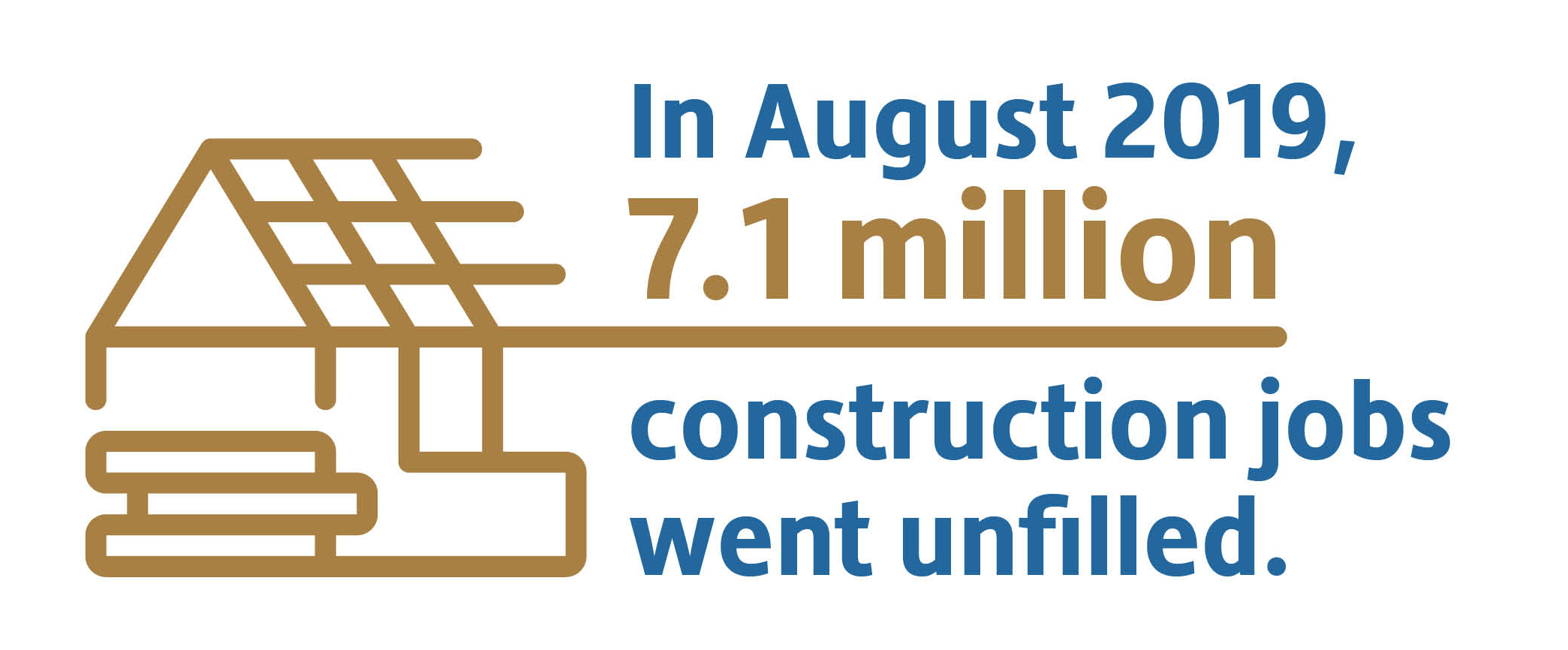

Investors are bullish on robots’ ability to solve persistent concerns in the construction industry, including safety issues, cost overruns, and a labor shortage that has 80% of companies struggling to fill jobs, according to recent data. Investors poured $3.1 billion in construction-related tech startups last year.

-

It may be going too far to say that unions are embracing the movement, but the International Union of Bricklayers and Allied Craftworkers is training its members on two machines from Construction Robotics: SAM, a bricklaying robot, and MULE, a robotic arm that can lift up to 135 pounds, easing strain on human workers.

-

Robots also hold the attractive quality of providing lower operating costs and improving efficiency for repeatable tasks. In Illinois, two general contractors are already reaping the benefits of construction robots as crews have been able to lay brick and hoist 32-inch foundation blocks faster and more efficiently for a 166,000 square foot barracks.

-

Bobcat recently unveiled its MaxControl system, which can turn an iPhone (or other iOS device) into a remote control for its compact loaders, with a range of 300 feet.

-

For mining applications, Caterpillar has developed Cat Command Dump (LHD) loaders, operated remotely by technicians with ergonomic controls, allowing equipment to go to less safe areas in mines, while lowering the risk of accidents.

-

One major technical challenge appears to be image stabilization. With herky-jerky images, remote operators are less effective—and, perhaps, a lot more dizzy.

Atalaya's take

“If you build it, he will come.” In the 1989 movie, Field of Dreams, Ray Kinsella (Kevin Costner) heard voices asking him to do the unimaginable – plow under his Iowa cornfield and build a baseball field to be visited by players, from the Chicago Whitesox, who had been banned by Major League Baseball for throwing the 1919 World Series (and, as an aside, 70 years later, were likely dead). Throughout the alternative asset management industry, technology assets share some of that same lore except the baseball players are replaced by dreams of sky high valuations and promises of business disruption.

As credit investors, we are, as a general matter, skeptical and take a ‘show me’ approach to investing. But, as in the case of Cobots, which we wrote about recently, robotics financing, seems to be something that, over the short term, could find its way to the front of our transaction workbench. Ray’s wife, Annie, despite her initial skepticism, encouraged Ray to follow his vision. We look forward to the prospect of having the opportunity to do the same with Atalaya (and, if you saw how the movie ends, we’d certainly finance the build out of some more stands).

In this series – “Financing Innovation” – we will explore how emerging technologies and processes are changing industries in ways that may become increasingly relevant for Atalaya and the equipment leasing market. We invite and encourage engagement, learning and dialogue with market participants. We welcome hearing about the ways in which the adoption of technology is shaping your business.

CONTACT US.